Understand PITI mortgage costs in 2026 with clear examples, smarter budgeting, and fewer surprises before you commit to a home loan.

When buyers talk about affordability, they often focus only on the monthly loan payment. However, lenders look at something bigger called PITI. If you ignore it, you may fall in love with a home that quietly stretches your budget too far.

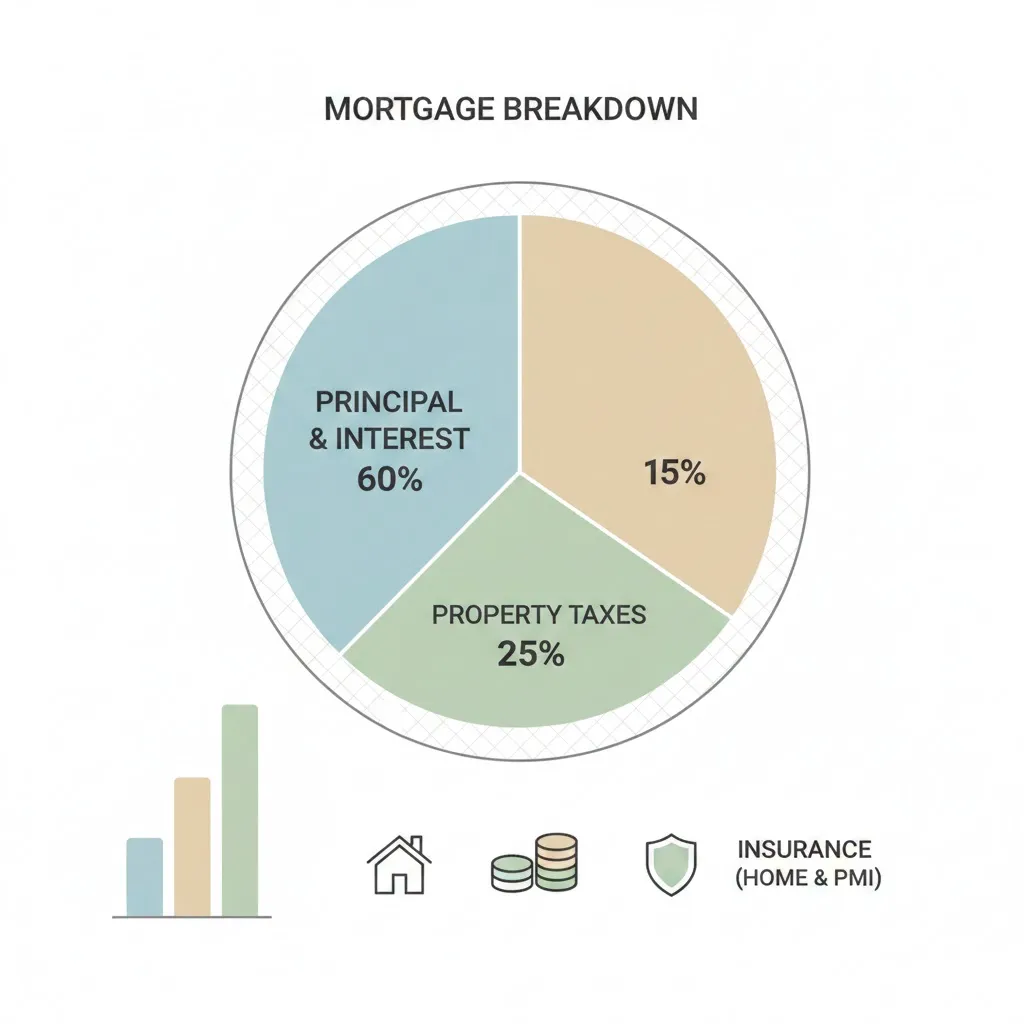

PITI mortgage stands for Principal, Interest, Taxes, and Insurance. Together, these four parts shape your true monthly housing cost. Once you see how they work together, your home search becomes clearer—and far less stressful.

For example, two homes with the same price can have very different PITI totals because taxes and insurance vary widely by location. That difference often determines approval.

What PITI Mortgage Really Means

PITI combines the four required components lenders use to judge affordability.

Principal

This is the portion of your payment that reduces the loan balance over time.

Interest

Interest is what the lender charges for lending you money. Early payments usually include more interest than principal.

Taxes

Property taxes are set by local governments and can change over time. Lenders often collect them monthly and hold the funds in escrow.

Insurance

This usually includes homeowners insurance. In some cases, it may also include mortgage insurance if your down payment is small.

Because PITI includes taxes and insurance, it reflects reality better than a simple loan payment estimate.

If you’re planning ahead, a mortgage pre-approval guide helps you see how PITI fits into lender calculations early.

Why Lenders Care So Much About PITI

Lenders don’t want you to struggle after closing. That’s why they use PITI to calculate your debt-to-income ratio, also known as DTI.

DTI compares:

- your total monthly debts

- your gross monthly income

Your PITI mortgage payment is usually the largest part of that equation.

Real-life micro-scenario:

A buyer qualifies easily based on principal and interest alone. However, once property taxes and insurance are added, their DTI jumps higher than expected. The loan amount must be adjusted to stay within guidelines.

This is why PITI often matters more than headline interest rates.

How PITI Affects How Much Home You Can Buy

PITI can limit your buying power even when your credit is strong.

Higher taxes or insurance can:

- reduce the loan amount you qualify for

- increase monthly payment stress

- affect approval margins

That’s why buyers comparing homes across cities or counties should always compare PITI, not just price.

If you’re comparing areas, a home affordability guide can help you spot these differences early.

PITI vs Principal and Interest Comparison

| Payment Type | What It Includes | What It Tells You |

|---|---|---|

| Principal & Interest | Loan repayment only | Basic loan cost |

| PITI | Loan, taxes, insurance | True monthly housing cost |

| Escrow payment | PITI collected monthly | Budget stability |

| Interest-only | Interest only | Temporary affordability |

This table explains why lenders rely on PITI, not just principal and interest, when approving loans.

How Escrow Connects to PITI

Most lenders use an escrow account to manage taxes and insurance. You pay one monthly amount, and the lender pays those bills for you when due.

This setup:

- prevents missed tax payments

- protects the lender’s collateral

- smooths budgeting for buyers

However, escrow amounts can change if taxes or insurance increase. That’s why PITI is not always static.

Pro Insight

Buyers who review property tax history before making an offer often avoid future payment shocks caused by reassessments after purchase.

Common PITI Mistakes Buyers Make

Many buyers underestimate PITI because they focus on the loan alone.

Ignoring tax differences

Two similar homes can have very different tax bills depending on the county.

Forgetting insurance variability

Insurance costs vary by region, weather risk, and even roof age.

Stretching to the maximum approval

Just because a lender approves a certain PITI doesn’t mean it’s comfortable long-term.

If you want breathing room, a home budget planning guide can help you choose a payment that still feels safe.

Quick Tip

When house hunting, ask lenders for estimated PITI, not just loan payments. It prevents last-minute affordability surprises.

FAQs About PITI Mortgage

Is PITI the same as my total monthly payment?

Often yes, but it may exclude HOA fees or utilities, which still affect your budget.

Does PITI include mortgage insurance?

It can. If required, mortgage insurance is often bundled into the insurance portion.

Can PITI change over time?

Yes. Property taxes and insurance premiums can increase or decrease.

Do all lenders use PITI?

Most do, especially for conventional, FHA, and VA loans.

Why does PITI matter for pre-approval?

Because lenders use it to calculate DTI and determine how much you can safely borrow.

Disclaimer

This article is for general informational purposes only and does not provide financial, legal, or lending advice. Mortgage terms and housing costs vary by lender and location.