Buying a home feels done once the offer is accepted. However, mortgage closing costs often catch buyers off guard right at the finish line. These fees are real, unavoidable, and important to understand before you sign anything.

Mortgage closing costs are the expenses required to finalize your home loan and transfer ownership. They are separate from your down payment and can add up quickly. Still, when you know what’s included and how to plan, they become manageable instead of stressful.

For example, a buyer in Texas may save carefully for a down payment, only to realize at closing that thousands more are needed for lender and title fees. That moment is common—but preventable.

Mortgage closing costs explained clearly for 2026, including what you pay, why it matters, and how to avoid last-minute shock.

What Mortgage Closing Costs Really Are

Mortgage closing costs are fees paid to lenders, title companies, government offices, and other parties involved in the home purchase.

They usually cover:

- loan processing and underwriting

- home appraisal and credit checks

- title search and insurance

- legal and recording fees

- prepaid taxes and insurance

These costs are paid at closing, either upfront or rolled into the transaction depending on your loan structure.

If you’re early in the process, reviewing a home buying checklist can help you see where closing costs fit into the bigger picture.

How Much Mortgage Closing Costs Usually Are

In most cases, mortgage closing costs range from 2% to 5% of the home’s purchase price. The exact amount depends on your loan type, location, and lender.

Real-life micro-scenario:

A buyer purchases a $350,000 home. Their closing costs land around $9,000. The down payment was planned. The closing costs were not—and caused a scramble.

This is why lenders provide a Loan Estimate early on. It outlines expected costs so you can prepare ahead of time.

If you’re comparing lenders, a mortgage rate comparison guide often reveals differences not just in rates, but also in fees.

Common Mortgage Closing Costs Explained

Some fees are unavoidable, while others vary widely.

Lender-related fees

These include origination, underwriting, and processing fees. They compensate the lender for preparing your loan.

Third-party fees

Appraisal, credit reports, and title services fall into this category. These are required to protect both buyer and lender.

Prepaid items

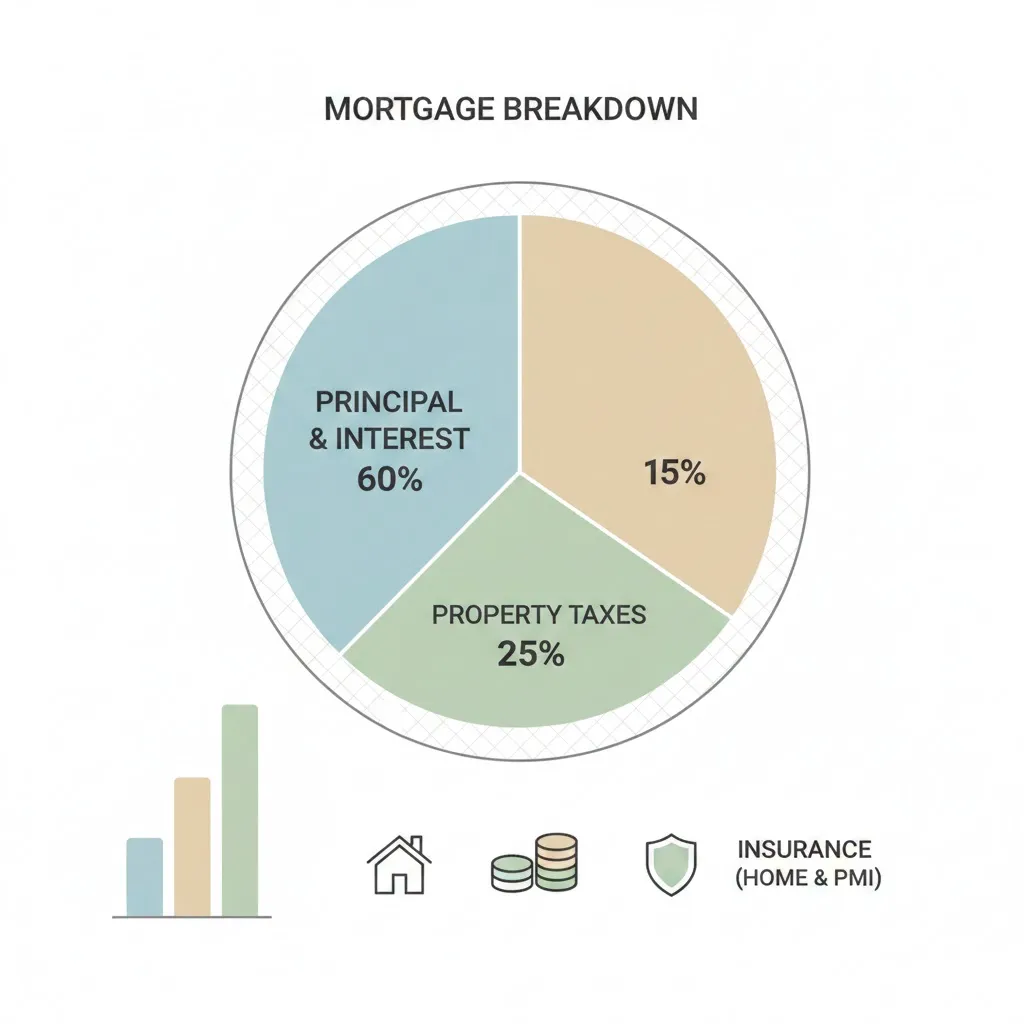

Property taxes, homeowners insurance, and interest are often prepaid to set up escrow accounts.

Understanding these categories helps you spot which costs are flexible and which are not.

Mortgage Closing Costs Comparison Table

| Cost Type | What It Covers | Usually Required |

|---|---|---|

| Loan origination | Loan processing and setup | Yes |

| Appraisal | Property value verification | Yes |

| Title insurance | Ownership protection | Yes |

| Prepaid taxes | Future property taxes | Yes |

| Discount points | Lower interest rate | Optional |

This table shows why closing costs are not one single fee, but a bundle of different charges.

Can You Reduce Mortgage Closing Costs

Yes, some parts are negotiable or avoidable with planning.

You may reduce costs by:

- comparing lender fees, not just interest rates

- asking the seller for closing cost credits

- choosing not to buy discount points

- closing at the end of the month to reduce prepaid interest

However, cutting costs should never mean skipping required protections like title insurance.

Pro Insight

Buyers who review the Loan Estimate line by line often save money by questioning duplicate or padded lender fees before closing day.

When You Pay Mortgage Closing Costs

Closing costs are typically due on closing day. They are listed clearly on the Closing Disclosure, which you receive at least three days before closing.

This document gives you time to:

- compare it to your original Loan Estimate

- ask questions

- confirm you have enough funds ready

If you’re preparing cash for closing, a home budget planning guide can help you avoid last-minute transfers or delays.

Quick Tip

Always review your Closing Disclosure early. Even small errors can delay closing or change how much cash you need.

FAQs About Mortgage Closing Costs

Are mortgage closing costs negotiable?

Some lender fees may be negotiable, but third-party and government fees usually are not.

Can closing costs be rolled into the loan?

Sometimes, depending on loan type and lender rules. This may increase your loan balance.

Do first-time buyers pay higher closing costs?

Not necessarily. Costs depend more on the loan and location than buyer experience.

Are closing costs refundable if a deal falls through?

Some fees, like appraisal costs, may not be refundable once paid.

How early should I plan for closing costs?

As soon as you start house hunting. Planning early prevents last-minute stress.

Disclaimer

This article is for general informational purposes only and does not provide financial, legal, or lending advice. Closing costs and loan terms vary by lender and location.