Car financing is how most people in the U.S. buy vehicles—but it’s also where many overpay without realizing it. Monthly payments feel manageable, paperwork moves fast, and before you know it, you’re locked into a deal that lasts years.

Good car financing isn’t about getting approved.

It’s about choosing a structure that fits your income, lifestyle, and long-term goals.

Disclaimer: This article is for educational purposes only and does not provide financial, legal, or tax advice. Financing terms vary by lender, state, and borrower profile.

What Car Financing Actually Means

Car financing simply means borrowing money to purchase a vehicle and repaying it over time. The car usually acts as collateral, which helps keep interest rates lower than most unsecured loans.

In practice, financing includes:

- Loan amount (vehicle price minus down payment)

- Interest rate (APR)

- Loan term (length of repayment)

- Monthly payment

A common scenario:

A buyer finds a reliable used SUV. Instead of paying $22,000 upfront, they finance part of the cost and spread payments over several years—keeping savings intact.

Car financing trades upfront cost for long-term commitment.

Why Car Financing Is So Common

Car financing fits modern budgets better than large cash purchases.

Lower upfront burden

Buyers don’t need to drain emergency savings.

Predictable payments

Most loans use fixed rates and fixed monthly payments.

Wide availability

Banks, credit unions, online lenders, and dealerships all offer financing.

Faster access to transportation

Reliable transportation often can’t wait for years of saving.

Used responsibly, car financing creates flexibility. Used carelessly, it becomes expensive.

Main Car Financing Options

Not all financing works the same way. Understanding options helps you compare fairly.

Bank or Credit Union Loans

Often offer competitive rates and transparent terms—especially credit unions.

Dealership Financing

Convenient and fast, but rates may include markup unless negotiated.

Online Auto Lenders

Offer pre-approval and rate comparisons before visiting a dealer.

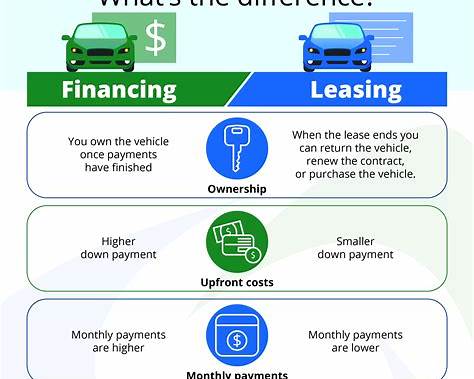

Leasing

Lower monthly payments, but no ownership at the end.

Car Financing vs Other Payment Methods

Here’s how financing compares to common alternatives:

| Payment Method | Monthly Cost | Total Cost | Ownership | Risk Level |

|---|---|---|---|---|

| Car Financing | Medium | Medium | Yes | Medium |

| Leasing | Low | High (long-term) | No | Low |

| Cash Purchase | None | Lowest | Yes | Low |

| Credit Card | High | Very High | Yes | High |

Financing balances ownership and affordability—but only when terms are reasonable.

How Lenders Decide Your Financing Terms

Approval and rates depend on several factors.

Lenders typically review:

- Credit score and history

- Income consistency

- Debt-to-income ratio

- Vehicle age and mileage

- Down payment size

Better credit and newer vehicles usually mean lower rates.

Pro Insight

Pre-approval from a credit union or online lender often gives you negotiating power at the dealership, even if you don’t use that loan.

Interest Rates, Loan Terms, and Real Cost

Car loans commonly range from 36 to 72 months. Longer terms reduce monthly payments—but increase total interest paid.

Key things to evaluate:

- APR (not just advertised rate)

- Loan length

- Fees rolled into the loan

- Prepayment penalties

A low payment can hide a high overall price.

Common Car Financing Mistakes

These errors cost buyers the most.

Shopping by payment only

Dealers can stretch terms to make payments look affordable.

Skipping pre-approval

Limits your leverage and comparison ability.

Rolling negative equity

Adds old debt into a new loan.

Ignoring total cost

Interest adds up quietly over time.

Quick Tip

Before signing, ask for the total amount paid over the life of the loan. That number often changes the decision instantly.

Who Car Financing Works Best For

Car financing is best suited for:

- Buyers with steady income

- People who want ownership

- Those preserving cash savings

- Borrowers with fair to good credit

It’s less ideal for:

- Unstable income situations

- Short-term vehicle needs

- Buyers tempted to overspend

Frequently Asked Questions About Car Financing

Is car financing better than paying cash?

It depends. Financing preserves cash but costs interest.

Can I negotiate financing terms?

Yes. Rates, fees, and add-ons are often negotiable.

Is dealership financing bad?

Not always—but comparing outside offers is essential.

Can I refinance later?

Yes, if credit improves or rates drop.

Does car financing affect credit?

Yes. On-time payments help; missed payments hurt.

Conclusion: Smart Financing Is About Control

Car financing should work for you—not against you. When you understand rates, terms, and alternatives, financing becomes a tool instead of a trap.

The smartest car buyers focus less on approval and more on affordability over time. That’s where real savings live.

Authoritative Sources

- Consumer Financial Protection Bureau — consumerfinance.gov

- USA.gov — Auto financing guidance

- Federal Trade Commission — ftc.gov

- U.S. Census Bureau — census.gov